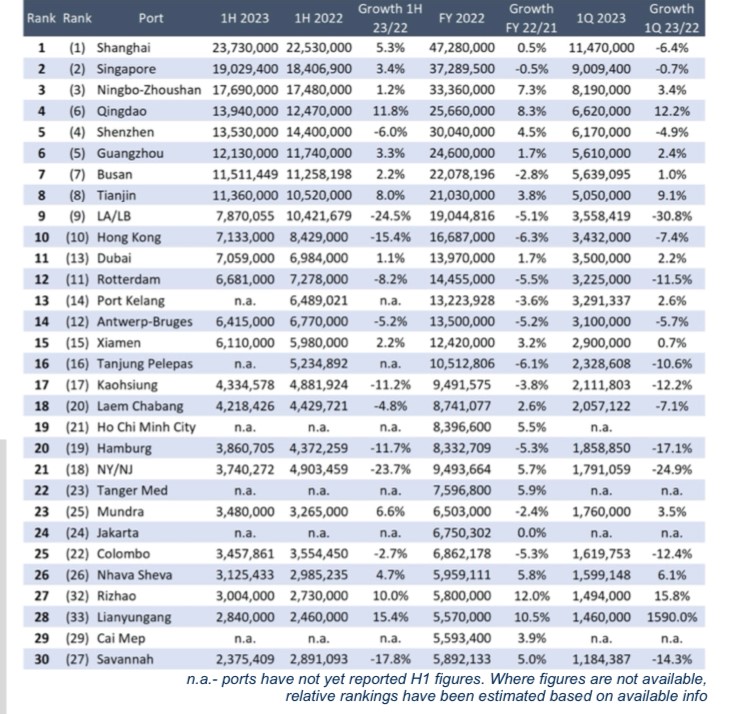

According to Alphaliner, port throughput plummets in Europe and the US as economic contractions take a toll. Moreover, Chinese Ports buck the trend with impressive gains; Middle Eastern ports surge in rankings.

Europe and the United States

The first half of 2023 has seen a sharp decline in port throughput across six major European and American ports, as the economic contraction in the Western world takes a toll on trade volumes. The ports of Los Angeles / Long Beach, New York / New Jersey, Savannah, Rotterdam, Antwerp – Bruges, and Hamburg have all reported significant reductions in container volumes, ranging from 5% to 25% for the period of January to June.

At the lower end of this spectrum, Antwerp – Bruges reported a 5% drop, which was somewhat artificially boosted by its merger with Zeebrugge in 2022. Without the merger, the decline would have been even more severe. However, the three major US ports experienced the most substantial declines, highlighting the economic challenges since the onset of the pandemic. Los Angeles / Long Beach recorded a staggering 25% fall in volumes, with a net loss of 2.6 million twenty-foot equivalent units (Mteu) compared to the same period in 2022.

There is some hope on the horizon for Los Angeles / Long Beach, as a new labor agreement for West Coast dockworkers has recently been signed. This agreement may help the port recover some of the business lost to East Coast ports over the past two years amid a challenging economic environment. East Coast ports in the US also saw significant declines, with New York / New Jersey reporting a 24% drop in traffic compared to the previous year, and Savannah recording an 18% decline.

China

In stark contrast, China reported a robust first half of the year, with total volumes processed at the country’s ports reaching 149.2 Mteu, marking a 4.8% increase. Shanghai posted an impressive 5.3% year-on-year increase, bouncing back from a slow start in the first quarter due to congestion and COVID-related issues.

Northern port Qingdao made significant strides, surpassing both Shenzhen and Guangzhou in the rankings during the first half of 2023, securing the fourth position after adding 1.47 Mteu to its half-year throughput. Whether Qingdao can maintain this momentum throughout the year remains to be seen, especially as its nearest competitor, Shenzhen, was one of only two Chinese ports, along with Hong Kong, to experience a decline in traffic during the same period. Qingdao has climbed from the 8th position in just five years. It’s worth noting, however, that Chinese throughput might face challenges, with export data indicating rapidly declining figures. The country reported its lowest export figures in over three years in July, although the decline slowed in August.

Mid-size Asian Ports

Mid-sized Asian ports did not perform as well during the first half of the year. Ports like Kaohsiung and Laem Chabang reported drops in traffic, at rates of -11.2% and -4.8%, respectively. In contrast, Port Klang, yet to report half-year figures, predicts a modest increase of just over 2% in volumes for the full year, aiming to regain some of the 500,000 twenty-foot equivalent units (teu) lost in 2022.

Middle East and Indian Subcontinent

In the Middle East and the Indian subcontinent, both of India’s major ports experienced traffic increases. However, Mundra continued to outpace Nhava Sheva, handling 355,000 teu more than its rival and solidifying its lead since surpassing its competitor in 2020. Meanwhile, Dubai surpassed Rotterdam in the rankings, driven by a modest 1.1% increase in throughput to reach 7.1 Mteu, while Rotterdam saw volumes fall by more than 8% in the same period. This shift in rankings suggests that Dubai could potentially overtake Hong Kong in the future, as Hong Kong appears on course to drop out of the top 10 for the first time, following six consecutive years of volume declines.

Source: Alphaliner