We share Alphaliner’s Top 10 container shipping lines: four hikers and four hikers in the first semester. The Average core EBIT margins for large global container lines reached another record high of 57.4% in the first quarter of this year, according to Alphaliner. With this level of profitability, carriers remain keen to take full advantage of the liner shipping boom by expanding their capacity.

However, the capacity of the world’s cellular container fleet only grew by a slight 1.7% in the first half of the year to 25.4 Mteu. Four carriers achieved much faster growth.

CMA CGM was fortunate to receive nine 15,000 teu newbuilds and Evergreen’s newbuild program also proved timely, despite these ships already being ordered in 2018 and 2019. ZIM posted the highest percentage growth (+16.8) %) by chartering many classic panamax vessels at high rates for periods of up to five years.

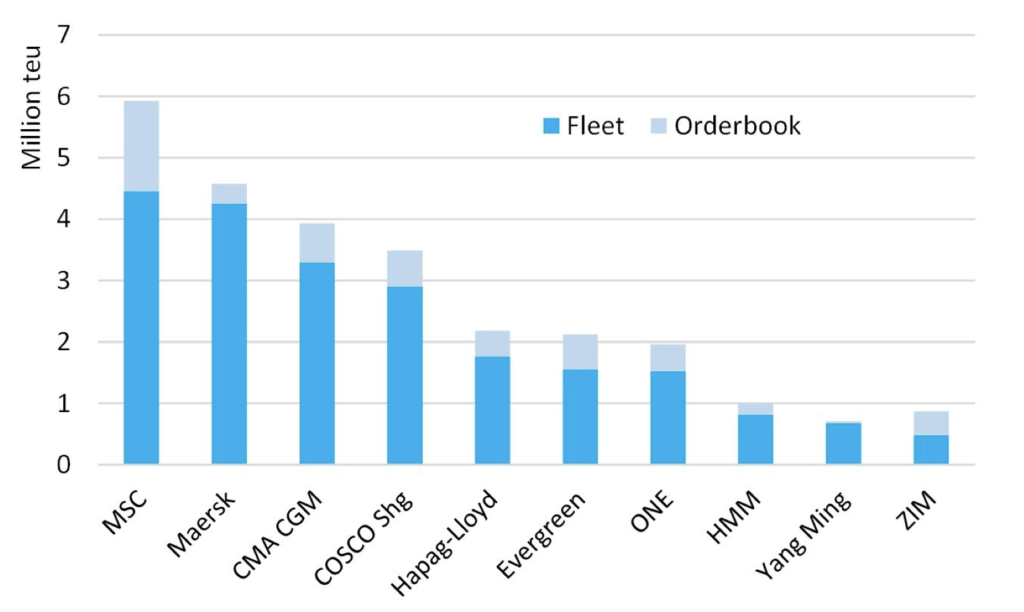

The growth champion in the Alphaliner Top 10 is undoubtedly MSC, which took over the No. 1 spot from Maersk in the first week of January 2022. The Swiss company controlled by the Aponte family continues its foray into the ship market second-hand and has already acquired 220 second-hand boats since August 2020.

In some cases, MSC paid more for second-hand purchases than the original order price for the ships. However, the big advantage of buying second-hand tonnage is that this capacity is readily available, which has allowed MSC to make the most of the bull market. By adding some 179,000 teu slots to its fleet in the first half (+4.2%), MSC has already created a gap of 200,000 teu with Maersk. The Danish operator was one of four carriers to see its fleets decline as it had to redeliver chartered vessels and was unable to find affordable replacements, Alphaliner reports.

It also reports that COSCO Shipping, ONE and HMM were the other three carriers with a slightly reduced fleet. ONE’s capacity loss was only partially offset at the end of June with the entry into service of the 11,923 teu ONE PARANA. Looking at MSC’s huge order book of 112 ships representing almost 1.47 Mteu, it is clear that the Geneva-based line will not only remain the market leader for the foreseeable future but will also increase its lead over other lines. Maersk’s order book currently stands at 322,000 TEUs, the report says.

Even if the Danish line orders a further twelve 16,000 TEU methanol-powered ships as expected, its backlog-to-fleet ratio will rise to “only” 12%, compared to 33% for MSC and almost 28% for the entire fleet.

In addition to MSC, there are two other lines that moved up one place in the Alphaliner Top 10 ranking. Evergreen has taken over ONE as the number 6 carrier after taking delivery of three 24,000+ teu ‘A class’ ships and the two last units of 12,000 teu ‘class F’.

ZIM’s active charter wave has led to its re-entry into the Top 10. The Israeli line overtook Wan Hai Lines, which now ranks eleventh on the list of the world’s largest container shipping companies.

Source: Alphaliner