Taking into account the pressure on the maritime industry to use more environmentally friendly fuels. The lines have reported their intentions to propel the new construction of container ships by reducing CO2 emissions into the atmosphere.

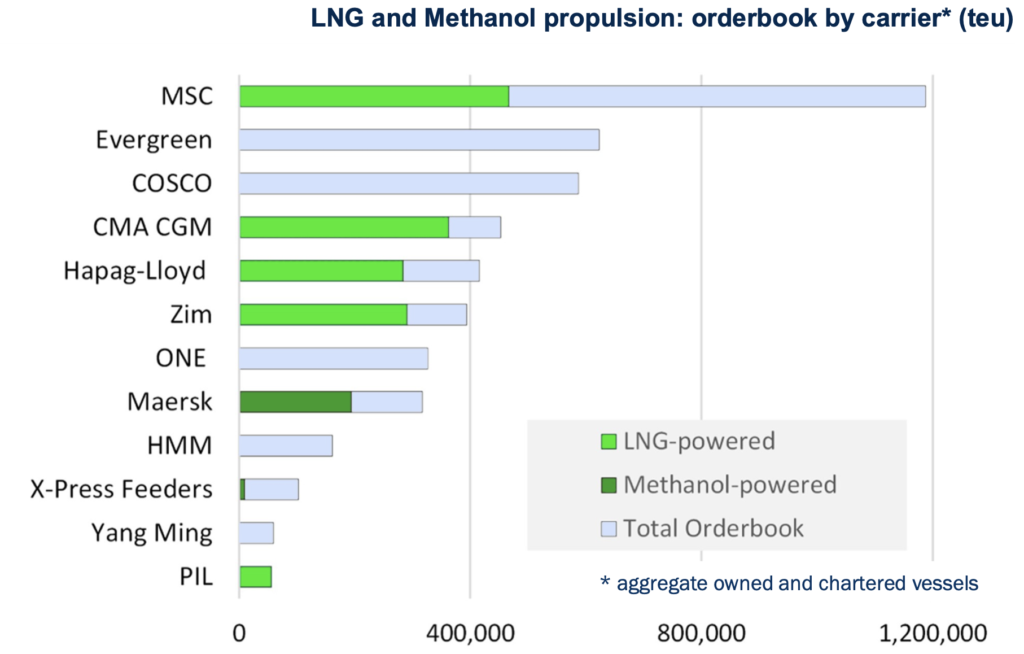

LNG-powered “dual fuel” containerships now comprise more than a quarter of the total order book by capacity following a surge in orders over the past year, Alphaliner reports.

According to the report, the percentage of newbuild orders for container ships with “alternative” propulsion options rises to 28% when methanol-powered units are added. Confirming that LNG now represents the most common alternative fuel option for the container industry, the number of ship losses has now risen to 138 ships, a total of 1.67 Mteu.

xThis compares with fewer than 50 ships of around 720,000 TEUs a year ago. Most of the new vessels will enter the market in 2023 and 2024. The CMA CGM Group continues to be the pioneer in the space, with the largest proportion of its order book dedicated to LNG propulsion at around 80% of contracted capacity. . This refers to owned vessels and chartered tonnage that is already committed to joining CMA CGM at the time of delivery, Alphaliner says.

In addition to this, CMA CGM is rumored to be in advanced negotiations to place orders for a further nine 23,000 teu LNG dual fuel megamax vessels with CSSC Group. Most likely, these ships would be sisters to the nine CMA JACQUES SAADE CMA-class units delivered in 2020 and 2021, reports Alphaliner.

Ultimately, MSC has been slow to adapt LNG and a new fuel option, but the carrier eventually changed its stance and placed orders for numerous LNG dual-fuel ships, directly or through charter commitments, reports maritime statistics consultancy, Alphaliner.