December inflation data puts future Fed cuts to bed

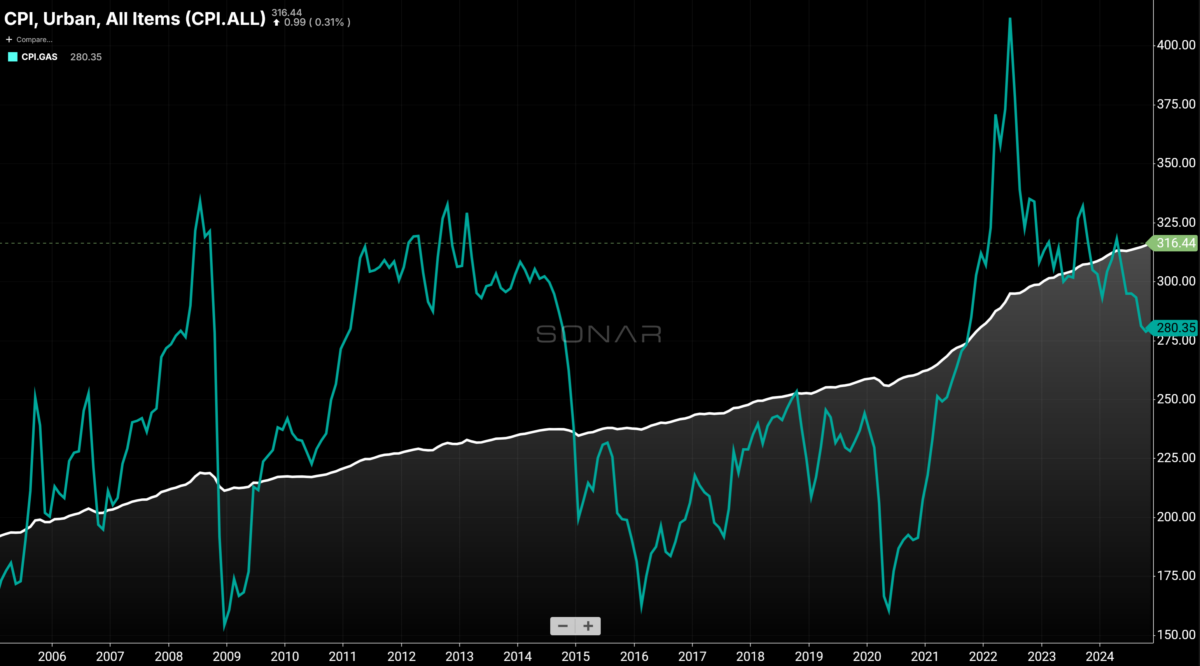

In December 2024, U.S. consumer inflation reached an annual rate of 2.9%, largely driven by a surge in gas prices. The Consumer Price Index (CPI) ticked up 0.4% from November, in line with economists’ forecasts.

The core CPI — which excludes items with volatile pricing like food and energy — rose by 0.2% month over month (m/m), rounding out 2024 with a 3.2% year-over-year (y/y) increase. This data betrays persistent inflationary pressures that weigh on both the trucking industry and the Federal Reserve’s appetite to continue cutting interest rates.

Still too hot to trot

Though prices have risen globally since Russia’s invasion of Ukraine in February 2022, U.S. inflation has been a roller-coaster ride that peaked around 9% y/y growth in June 2022.

To learn more about FreightWaves SONAR, click here.

The initial spike was largely attributable to a surge in energy prices, but pandemic-induced supply chain disruptions and labor shortages both precipitated and sustained the U.S. inflation crisis. Of course, trillions of dollars of government spending under both the Trump and Biden administrations helped to inflame the crisis as well, though supporters argue that much of this spending staved off an economic depression

Despite aggressive int…

Comments are closed, but trackbacks and pingbacks are open.