According to Alphaliner, ANTAQ, Brazil’s national waterway and maritime transport authority, ANTAQ (Agência Nacional de Transportes Aquaviários), has started the process of public planning and stakeholder engagement to develop a new container terminal at the port plus country’s largest, Santos.

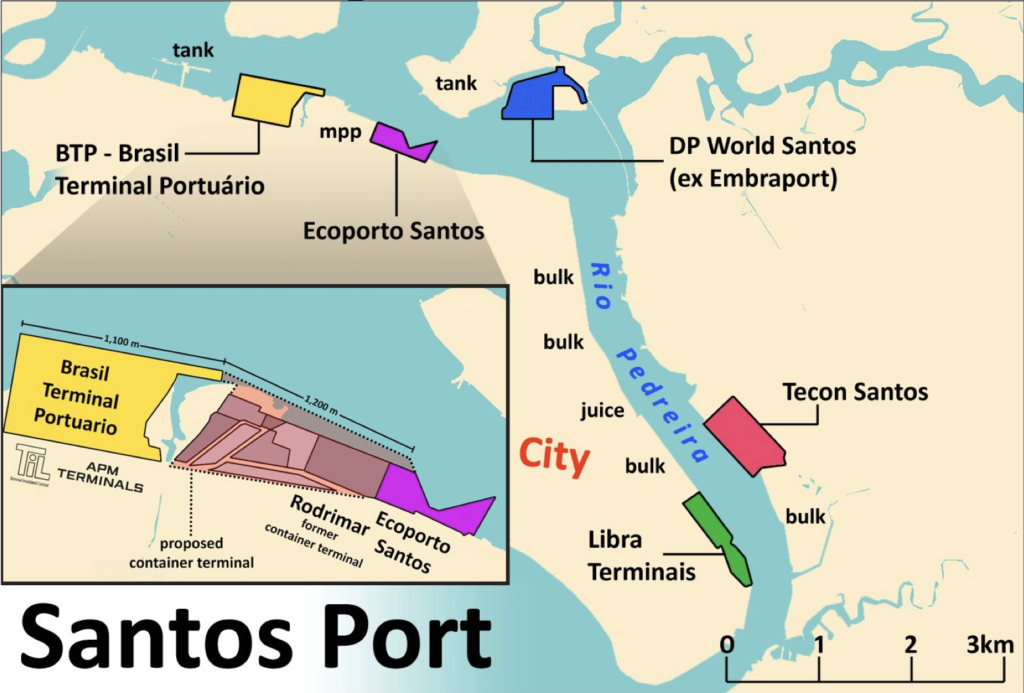

Called the ‘STS10’ plan, the project aims to create a 46-hectare container facility with a 1,200m berth and a design capacity to handle a volume of 1.90 Mteu per year. Numerous prominent players in the shipping industry and port terminals, including Maersk Group (APMT) and MSC (TIL), would be interested in the concession to operate the terminal, Alphaliner says.

It also reports that since 2013, Maersk Group and MSC already jointly controlled Brasil Terminal Portuario (BTP) in Santos, a 50:50 joint venture between TIL and APMT. The BTP terminal offers a 1,100 m wharf with an estimated design volume handling capacity of 1.50 Mteu per year.

ANTAQ announces that the new container terminal ‘STS10’ is planned to be developed under a 35-year concession and is expected to cost at least BRL 2,200m (USD 456m) to build.

It would be built directly next to BTP with a series of older, smaller general cargo berths that will disappear under the footprint of the terminal. However, the source reports that the fact that the main maritime carriers, or their respective terminal operator groups, are the main candidates for the new Santos concession has raised concerns among operators that are not affiliated with a shipping line. Since these companies claim that carriers would use their position to systematically divert traffic from terminals in which they are not invested.

While shipping lines dispute this claim, the Brazilian government has acknowledged that market concentration and the growing power of shipping lines is a concern. To address this concern, Alphaliner reports, Maersk and MSC were barred from joint bids for ‘STS10′ and instead have to compete for the concession. According to ANTAQ, this would ensure that competition between Santos’ container terminals would remain healthy.

However, Alphaliner reports that the agency had already launched a mandatory public consultation process for the development of the new terminal and that stakeholders, particularly those whose businesses would have to close or relocate, will still have the opportunity to express their concerns.

ANTAQ plans to complete the consultation process well before mid-2022 and plans to invite formal bids for the ‘STS10’ concession in the fourth quarter, Alphaliner states.

Typically, the construction of a container terminal with the dimensions of the proposed facility in Santos will take four years. In that vein, the proposed ‘STS10’ is not expected to come online before 2025.