J.B. Hunt’s record intermodal loads came with higher costs in Q4

J.B. Hunt Transport Services said peak season for its intermodal and highway services segments was strong and that it’s seeing some customers secure capacity earlier than normal, which is usually a harbinger of an improving environment.

The Lowell, Arkansas-based multimodal transportation provider reported earnings per share of $1.53 Thursday after the market closed. The result included a roughly 13-cent headwind, or $16 million, from intangible asset impairments. The consensus estimate for the period was $1.62 per share and in line with the company’s result excluding the charges.

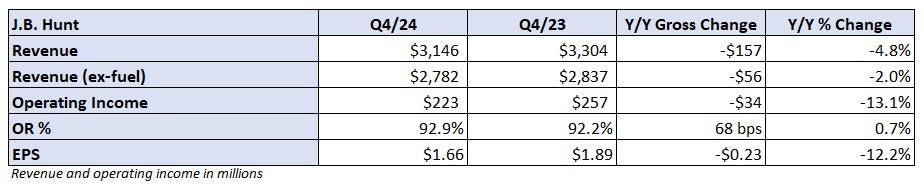

Consolidated revenue fell 5% year over year to $3.15 billion. Adjusted operating income of $223 million (excluding the impairments) was 13% lower y/y.

The company guided to a 20% to 25% sequential decline in consolidated operating income (after consideration of the one-off charges) from the fourth to the first quarter, assuming normal seasonal trends. That is in line with its prior 10-year experience excluding two of the pandemic years.

The fourth-quarter result and guide sent shares of J.B. Hunt (NASDAQ: JBHT) 11.1% lower in after-hours trading on Thursday.

Operating income, margins and earnings per share in the following tables have been adjusted to exclude the one-off charges from the 2024 fourth quarter as well as $53.4 million in insurance-related items across various segments in the 2023 fourth quarter.

Intermodal volumes strong, waiting on pricing to turn

Intermodal revenue fell 2% y/y to $1.6 billion as loads increased 5%, but revenue per load was down 6% (down 3% excluding fuel surcharges). J.B. Hunt saw record volumes in the quarter with transcontinental moves up 4% and Eastern loads 6% higher even as the mode competed with low truck rates.

Total intermodal traffic on the U.S. Class I railroads was up 9% y/y in the quarter, according to the Association of American Railroads.

Comments are closed, but trackbacks and pingbacks are open.