December data from Cass Information Systems showed a significant drop in freight shipments as expenditures were off by a lesser amount, implying freight rates moved higher during the month. Truckload linehaul rates continued to improve from August’s cycle low, a Tuesday report revealed.

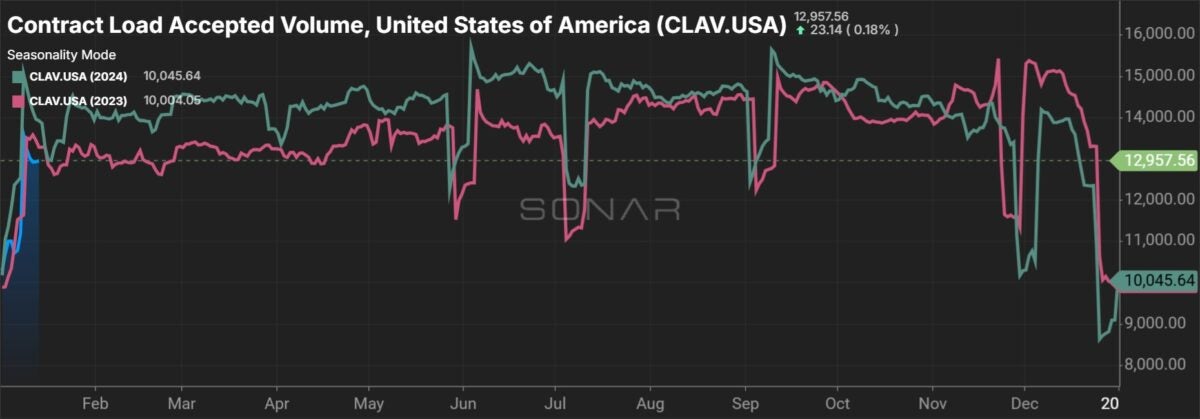

Freight volumes captured by the Cass Freight Index fell 7.3% from November and were off 6.5% year over year. Even excluding the typical November-to-December seasonal dip, the index was off 3.1%, which wiped away November’s 2.8% sequential gain.

This was the largest y/y decline for the shipments index since January 2024 and the lowest index reading since June 2020. However, there was some noise during the month. Midweek holidays may have exacerbated the seasonal slowdown. Also, some shippers pulled forward freight deliveries throughout the fall to avoid a potential dockworker strike on Jan. 15.

| December 2024 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -6.5% | -13.3% | -7.3% | -3.1% |

| Expenditures | -3.4% | -26.3% | -2.6% | 0.5% |

| TL Linehaul Index | -0.4% | -6.5% | 1.2% | NM |

Volumes are off to a slow start in January as well, but winter storms have been widespread and some indecision over trade policy lingers ahead of Monday’s inauguration of President-elect Donald Trump.

The Cass Freight Index is a trucking-centric dataset with more than half of the spend captured tied to truckload shipments. Less-than-truckload, railroad and parcel shipments largely make up the rest.

The report said that “ongoing capacity additions are keeping pressure on the for-hire market.” Cass’ January forecast calls for volumes to be down 6% y/y, assuming normal seasonal trends.

The index finished 2024 down 4.1% y/y after falling 5.5% in 2023.

Comments are closed, but trackbacks and pingbacks are open.