he Red Sea remains an area of uncertainty, marked by ongoing Houthi-led attacks on shipping and recent air raids on Houthi militia facilities, prompting the multinational US-led military operation, Operation Prosperity Guardian. However, confidence in navigation safety has not been fully restored. Many ocean carriers are adopting a cautious approach, choosing to reroute vessel traffic to the longer Cape of Good Hope route.

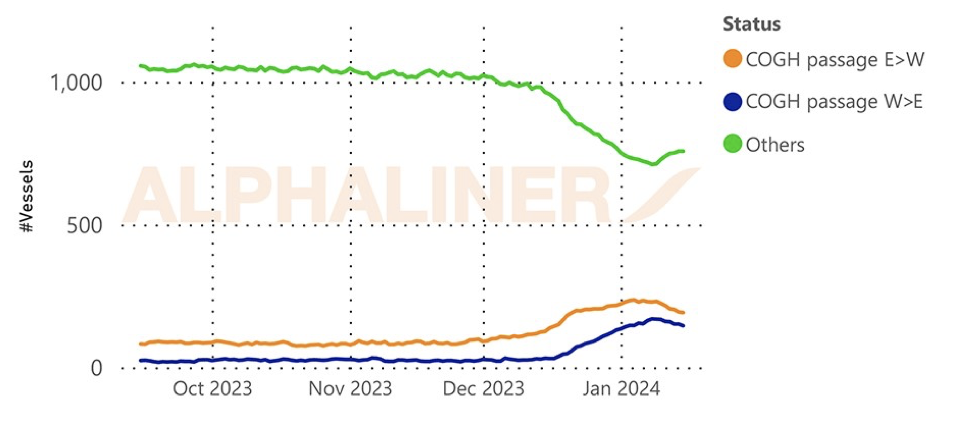

As of January 15, Alphaliner has identified 338 vessels on Cape diversions, with 192 on westbound and 146 on eastbound voyages. This count includes ships from scheduled liner services that originally used the Suez Canal before the Red Sea attacks, excluding vessels with normal Cape routings such as Far East – ECSA services and Far East – West Africa loops.

A small number of vessels in West Africa have been rerouted, either on off-schedule ‘extra-sailer’ duties or Asia – Europe vessels performing bunkering or ad hoc cargo calls in African ports. The tool used for counting rerouted vessels via the Cape does not differentiate between diversion reasons. It is noted that even before the Houthi attacks, some ships were rerouted to the Cape for commercial reasons, particularly on poorly-booked voyages during times of low demand.

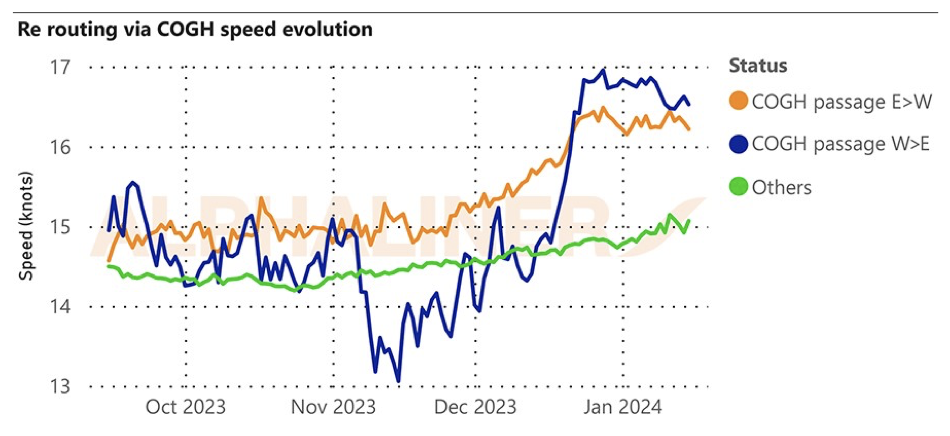

Carriers have increased the speeds of westbound sailings on rerouted vessels by approximately 1.5 knots, reaching an average speed of 16.5 knots. While seemingly modest, this speed increase is significant, ensuring that Cape of Good Hope sailings on the Asia to Europe route are just fast enough for ships to arrive exactly one week later than their original routing at the ‘old’ speed of 15 knots.

Carriers aim to maintain arrival within designated fixed-day ‘ETA slots’ at destination ports, with a one-week delay. This strategy is effective unless services include underway calls in the central or east Mediterranean. Overall, Cape re-routings pose no major challenges for shipping, provided carriers have sufficient capacity to fill the additional schedule slots created by diversions with extra tonnage.

Source: Alphaliner, Reuters.