Trump’s Bold Shipbuilding Vision: Revolutionizing the Ocean Cargo Industry in 2025

By Lisa Baertlein

Potential Impacts of Trump’s Shipping Industry Revitalization Plan

LOS ANGELES, March 7 (Reuters) – The initiative by President Donald Trump to rejuvenate the U.S. maritime sector may impose significant financial burdens on ocean freight operators and trigger a new wave of global supply chain disruptions, industry leaders have informed Reuters.

Funding the Shipbuilding Revival

The Trump governance’s strategy seeks to finance a resurgence in American shipbuilding through perhaps substantial port tariffs on vessels constructed in China, as well as those from fleets that include Chinese-manufactured ships. This data comes from a draft executive order reviewed by Reuters.

Financial Ramifications for Consumers and exporters

The proposed fees could affect nearly all ships docking at U.S. ports, leading to an estimated annual cost increase of up to $30 billion for American consumers and potentially doubling shipping expenses for U.S. exports, according to the world Shipping Council (WSC), which advocates for the liner shipping sector.

“Policymakers need to rethink these harmful proposals and explore alternative strategies that bolster American industries,” stated WSC CEO Joe Kramek.

h3>Aiming for Domestic Growth Amidst Global Challenges

The primary objective behind Trump’s plan is to revive the struggling U.S.shipbuilding industry while diminishing China’s influence in global shipping markets. Though,feedback from industry executives indicates that such pro-American policies can inadvertently lead to outcomes contrary to their intended effects.

Potential Disruptions in Ocean Freight Operations

This initiative has been described as a “curve ball,” with potential adverse effects on ocean carriers and their clientele, according to Jeremy Nixon, CEO of container shipping company Ocean Network Express (ONE), during S&P Global’s TPM container shipping conference held recently in Long Beach, california.

In response to these changes, ship owners might reduce their visits to U.S. ports as a means of avoiding additional fees. This could result in an influx of cargo at fewer ports—complicating logistics for both imports destined for retailers and manufacturers as well as exports awaiting shipment.

Reallocation Challenges Facing Shipping Fleets

The proposed regulations may compel companies to adjust their global fleet deployments so that vessels not built in China are redirected towards servicing the united States market—a process likely fraught with time delays and increased costs.

MSC, recognized as the largest container carrier globally,may opt out of smaller ports like California’s Port of Oakland , crucial for exporting fresh beef products, dairy items, and almonds—to lessen operational impacts according Soren Toft, MSC’s CEO at TPM.

Potential Bottlenecks at Major Ports

This shift could overwhelm major ports across the nation while sidelining smaller ones—echoing early pandemic-related congestion issues that severely disrupted international trade flows.

“It would be extremely challenging for us along with our partners if we faced such sudden volume increases,” remarked Beth Rooney,

director at New York/New Jersey port—the largest on America’s East Coast—regarding anticipated spikes in cargo volume.

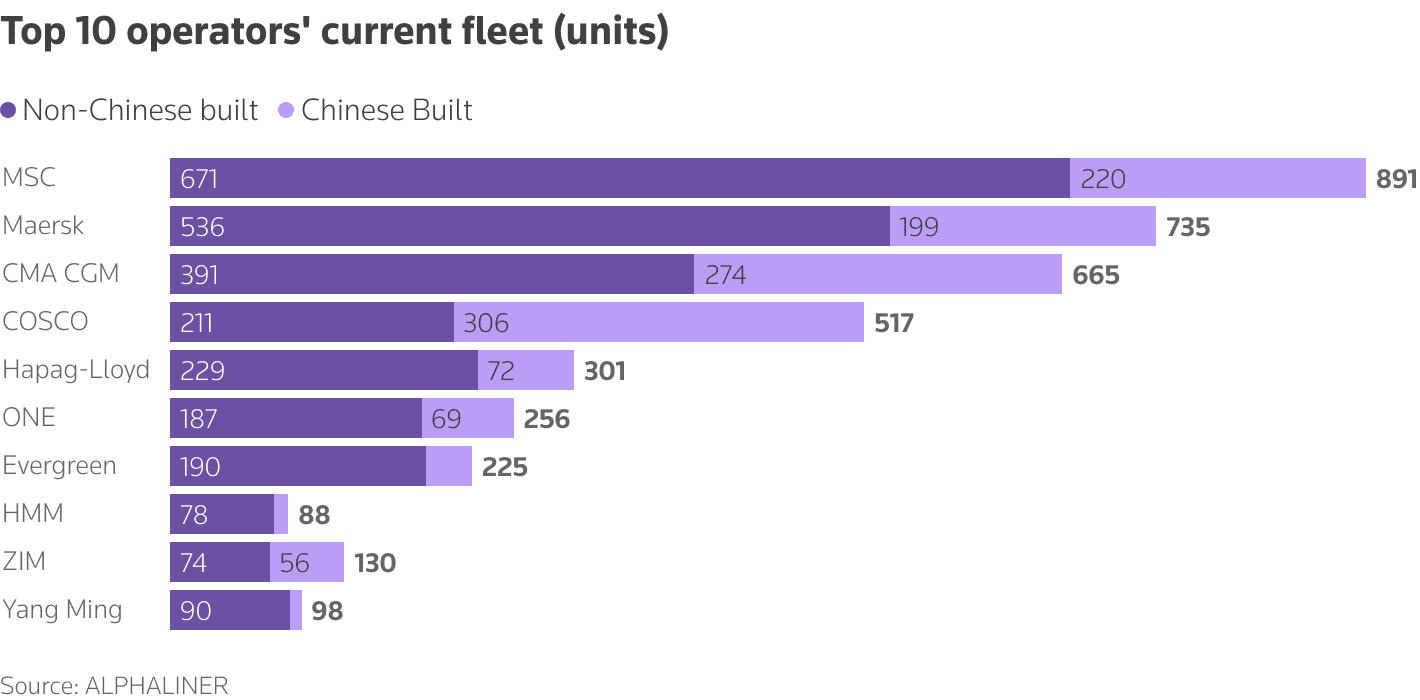

Status Update: Fleet Composition Among Leading Operators

(Reporting by Lisa Baertlein in Los Angeles; Jacob Gronholt-Pedersen in Copenhagen; Elke Ahlswede in Hamburg; Renee Maltezou in Athens; edited by Chizu Nomiyama)

(c) Copyright Thomson Reuters 2025.

Trump’s Bold Shipbuilding Vision: A Game-Changer for the Ocean Cargo Industry?

In the ever-evolving landscape of global trade, few subjects ignite as much conversation as the ambitious shipbuilding vision championed by Donald Trump. As the world navigates the complexities of international shipping and cargo logistics, Trump’s proposals present a distinct approach that promises to revolutionize the ocean cargo industry.

The Foundation of a Maritime Renaissance

At the heart of this vision lies the potential for robust economic growth and innovation in shipbuilding. With a focus on modernizing America’s maritime capabilities, this initiative seeks to bolster the nation’s position as a leader in global commerce. But what exactly sets this vision apart?

Key Features and Innovations

- Investment in Cutting-Edge Technology: By embracing advanced technologies, including automation and environmentally-friendly designs, Trump’s shipbuilding strategy aims to enhance efficiency and reduce the carbon footprint of shipping operations.

- Job Creation: A renewed focus on domestic shipbuilding could catalyze job growth, creating thousands of jobs in construction, engineering, and maritime logistics.

- National Security: By revitalizing shipbuilding capacities, the initiative also seeks to bolster national security, ensuring that the U.S. maintains a strong maritime presence in turbulent global waters.

Benefits to the Ocean Cargo Industry

The implications of this vision extend far beyond national borders. The ocean cargo industry, a critical pillar of international trade, stands to gain significantly from this ambitious blueprint:

- Enhanced Efficiency: Upgraded ship designs and technologies promise to optimize shipping routes and reduce transit times, improving overall cargo delivery.

- Cost Reduction: By investing in modern shipbuilding, operational costs could be slashed, leading to more competitive pricing in the global market.

- Sustainability Focus: With increasing global awareness regarding climate change, sustainable shipbuilding practices can position U.S. carriers as frontrunners in eco-friendly shipping.

Conclusion: A Vision Worth Watching

As debate swirls around Trump’s shipbuilding vision, one thing remains clear: the potential ramifications for the ocean cargo industry are profound. By investing in innovation and infrastructure, this bold initiative could herald a transformative era for maritime commerce. Will it be the game-changer analysts predict, or is it merely a vision that will drift into the seas of speculation? Only time will tell, but for now, the ocean waves are alive with possibilities.

Stay tuned to our blog for further insights and analysis on this unfolding story that impacts not just the maritime industry, but the global economy at large.

Comments are closed, but trackbacks and pingbacks are open.