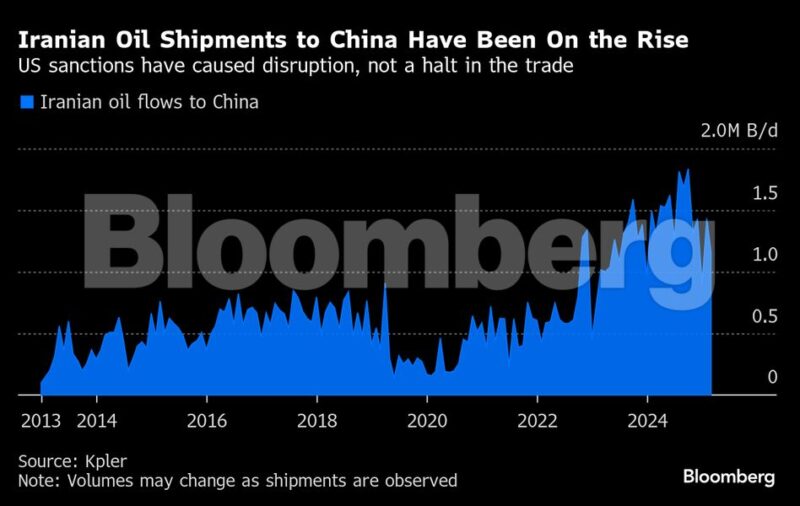

Sanctions Stranglehold: How China’s Iran Oil Trade Continues to Thrive

By Serene Cheong

March 8, 2025 (Bloomberg) – Ongoing sanction measures targeting entities and vessels allegedly supporting Tehran are beginning to hinder the flow of Iranian oil to China. This is occurring as costs escalate, forcing traders into precarious strategies to bypass U.S. restrictions.

In recent weeks, Chinese private refineries—key purchasers of Iranian cargoes—have reported disruptions in shipments due to a series of seller defaults. Although no specific reasons were disclosed, executives attributed these issues to logistical hurdles and rising operational costs affecting the supply chain.

The situation has been exacerbated by sanctions imposed on certain Iranian tankers while en route,further complicating matters for buyers who requested anonymity due to the sensitivity of the discussions.

The Impact of Sanctions on Trade Dynamics

China has historically relied on trade with Iran as its primary source for oil imports; however, this relationship is under increasing scrutiny from Washington. Following recent sanctions targeting tankers and their operators, over two-thirds of approximately 150 vessels involved in transporting Iranian crude last year have now been blacklisted by U.S. authorities according to Kpler’s data analytics.

China’s Stance Against Unilateral Sanctions

Despite not recognizing unilateral sanctions imposed by the U.S., China continues to assert its right to engage in trade with Iran. Though, many ports and shipping companies outside mainland China are hesitant about dealing with sanctioned entities due to potential repercussions from the extensive U.S. financial system—especially as President Trump signals a commitment towards stricter enforcement.

the Rising Costs of Circumventing Restrictions

navigating around these restrictions comes at a steep price; charter rates for non-sanctioned supertankers transporting Iranian oil from Malaysia have surged between $5 million and $6 million this month—a record high reflecting an increase up to 50% compared with last year.

The reliance on smaller tankers—which are less efficient than larger counterparts—has also increased considerably according to Kpler data analysis. As an example, a ship-to-ship transfer involving an Iranian supertanker occurred off Malaysia recently using three Aframax-sized vessels—a notably slow and costly operation.

Shipping analysts highlight that as more vessels fall under U.S. sanctions lists; fewer ships remain available for operations crucially dependent on maritime transfers requiring numerous ships at sea.

Challenges in Pricing Strategies

Mediators typically present offers for Iranian oil based on fixed differentials against global benchmarks like Brent futures which encompass cargo value along with additional expenses such as tanker bookings (often requiring multiple vessels), STS transfers (Ship-to-Shore), insurance premiums and port charges.

A sudden rise in any associated costs or delays can jeopardize traders’ profits or even render deals unfeasible altogether while higher prices may deter cost-sensitive Chinese buyers from proceeding with purchases. Recently reported offers for delivery of Iranian crude into China indicated narrowing discounts ranging between $0.50-$1 per barrel against Brent futures compared with previous weeks where discounts were noted at $1-$1.50 per barrel.

Mia geng from FGE Group notes that meaningful increases in freight rates pose challenges since passing these expenses onto buyers proves tough: “Chinese importers will seek substantial discounts amid shipment delays which could diminish sellers’ profit margins.”

Comments are closed, but trackbacks and pingbacks are open.