The amendments to MARPOL Annex VI are effective as of November 1, 2022. The requirements for EEXI and CII certification become effective on January 1, 2023. This means that the first annual report will be completed in 2023, with initial ratings awarded in 2024. However, according to Alphaliner, shipping lines are criticizing the new carbon intensity rating (CII) system and in turn calling for a reassessment of its methodology.

Just two months before the new IMO Carbon Intensity Indicator (CII) regulations for the shipping industry come into effect, shipping lines have begun to raise concerns about the impact of the rating scheme on global shipping.

In recent interviews and media commentary, management-level staff from MSC, Maersk and Hapag-Lloyd individually criticized IMO’s approach to calculating the CII, claiming that the rules were “not sensible” or even counterproductive.

MSC stated that enforcing the CII could reduce the effective capacity of container ships by up to 10%, because it will force some less efficient ships to slow down in order to remain compliant.

The question of whether the shipping lines’ concerns are justified or exaggerated is a difficult one to answer. While some of the recent criticism is surely valid, the side effects of the introduction of CII will largely depend on the fleet of each shipping line, the size and age of the vessel, the speed of navigation, and the routes served.

What are CII, EEDI y EEXI?

To fully appreciate the effects that the CII will have on shipping line shipping, it is important to understand that the index is fundamentally different from the better known EEDI (Energy Efficiency Design Index) and EEXI (Existing Ships Energy Efficiency Index). .

While both the EEDI and EEXI are unique ratings given to a ship based on its design specifications, the CII is an operational index given to a ship based not only on its technical characteristics, but also on consumption. fuel and the navigation distance of each and every one of its services.

Therefore, CII ratings may change from year to year depending on the commercial pattern of the vessel and factors such as speed of voyage and time spent in port.

Starting in 2023, enabling CII will be mandatory for all vessels over 5,000 gross tons.

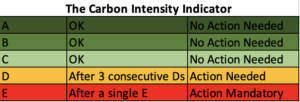

The index measures the CO2 emitted by cargo transport capacity per nautical mile. Based on this, ships are given a rating from ‘A’ (efficient) to ‘E’ (inefficient). Ships rated ‘D’ for three consecutive years or ‘E’ in a single year are required to submit an action plan to improve energy efficiency and thereby reduce emissions. This could mean the mandatory conversion of ships to LNG to increase efficiency or other mitigation measures.

As an operational indicator, the CII will be assessed annually starting in 2023 with more stringent annual emission limits on a 2019 fleet basis.

This means that a ship that had a ‘C’ rating in one year could drop to a ‘D’ rating in subsequent years, without the aforementioned changes to the ship’s operating pattern, simply due to the yearly ‘progression factor’. which makes CII Compliance more demanding.

Technically, the CII is calculated on the basis of an “annual efficiency index”. The IMO formula is based on the ship’s deadweight (ie capacity) and annual sailing distances, but does not take into account the actual load factors of the cargo. Basically, you divide the annual emissions from ships by the cargo capacity of the ship and the distance sailed.

With this approach, the IMO does not differentiate between well-filled ships and ships that are sailing half empty. To some extent, this method also penalizes ships that (must) stay long periods in port or at anchor. During these waiting periods, the ships do not generate many emissions, but they also do not add to their total annual sailing distance. In general, wait times can drag down the CII ratings of individual ships.

Ironically, this could lead to situations, for example in borderline cases between classifications, where it would be better for a ship to circle slowly rather than wait at anchor.

This is because the relatively low emissions from slow sailing are offset by additional miles sailed at an eco-efficient speed, while the lower emissions from anchoring are not.

While such behavior might make sense to improve a ship’s rating, it is obviously counterproductive from an environmental standpoint.

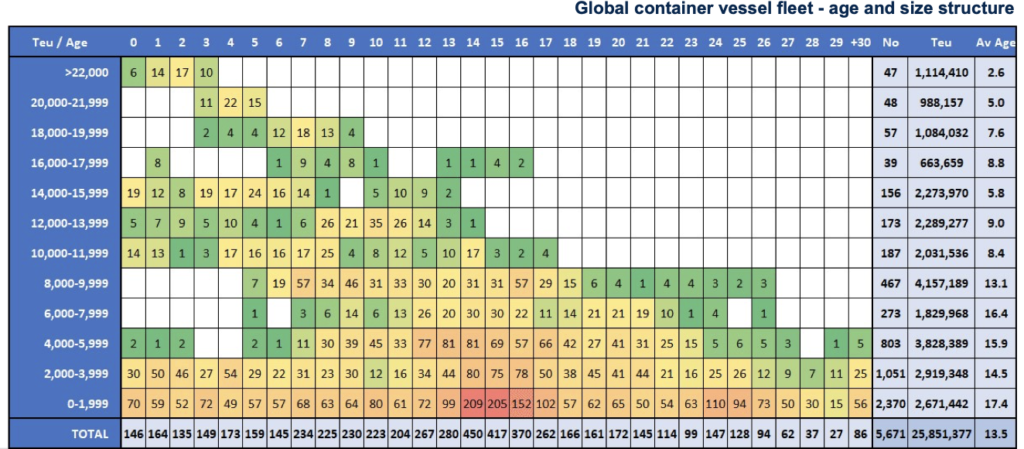

For now, the CII is not a problem for the main big ships; Physics dictates that bunker consumption, and thus carbon emissions, increase disproportionately with ship size, but exponentially with speed. Since the CII measures energy consumption by load capacity and distance, the index naturally favors large ships.

Since the group of large and ultra-large container ships is quite young, with efficient hull designs and modern engines, the CII will hardly affect the capacity of large mainline vessels.

Alphaliner estimates that the mandatory engine power limitations and therefore speed restrictions will initially only have a very limited effect on most large container ships. This will only change over time, when the CII becomes “tighter”.

Initially, however, individual Existing Ships Energy Efficiency Index (EEXI) speeds in the upper half of the size range (approx. 10,000 to 24,000 teu) will generally be higher than actual sailing speeds. Typically the EEXI speed limit for a relatively modern large ship will not be less than 21 knots.

In other words: most of the major shipping line container services will not have to slow down to remain compliant because they are already operating in slow shipping mode. Therefore, the CII’s effect on “dynamic” port-to-port capacity is expected to be close to “nil” in the coming years, at least for the 10,000+ TEU sector. This could gradually change in the second half of the decade.

Fleet of smaller ships if you will feel the effect of the CII

The picture is less clear for several reasons. Two main factors muddy the waters and make capacity predictions difficult:

First, there is the structure of the service: unlike the larger ships that are

Primarily deployed in deepwater services with long sailing distances between continents, small ships trade in a multitude of individual services. These include regional services in developing countries with short shipping distances and restricted port infrastructure. In these situations, ships often spend a long time in port or waiting at anchor.

At the same time, small and medium-tonnage vessels are also deployed in deep-water services or niche loops (high reefer, fruit express, etc.), where most of the vessels’ time is spent at sea, operating at design speed.

Second, age and technical specifications vary much more in the smaller boat group. The sector contains decades-old ships alongside modern state-of-the-art ships.

Taking the 2500 TEU size cluster as an example, shipowners estimate that ship speeds could be limited to around 17 knots for older ships and 19 knots for modern “eco” ships.

The capacity effect of this speed limit depends on each ship individually (efficiency vs. consumption) since they are aligned with the service profiles (slow or fast, long navigation distances or regional loops, etc.).

For its part, Alphaliner predicts that, initially, the CII will have a very limited effect on capacity in the smaller sizes. However, the landscape could change markedly in the coming years, as the baseline changes and regulations become increasingly stringent.

Compared to the mainline shipping services, smaller regional vessels and feeders will feel the pinch much sooner and much more strongly.

This could lead to mergers of services, increase in vessel size and could result in the retirement of numerous older vessels.

In general, Alphaliner believes that some shipping lines’ predictions of negative capacity effects greater than 10% are exaggerated. The real-life consequences are likely to be minor and will only ‘infiltrate’ the shipping chain, rather than materializing overnight in 2023.

Delivery of new construction ships will overcome the effects of the CII in the short term

While it’s almost impossible to determine the exact amount of vessel dynamic capacity that the new carbon emissions regulations will affect, one thing seems certain:

Any reduction in capacity due to the effects of CII and EEXI will be far less than the huge amount of capacity that newbuild tonnage will throw into the supply of shipping lines.

The world order book for container ships stands at almost 7.5 Mteu of capacity or just under 30% of the existing world fleet. Of these, 2.52 Mteu of capacity expire in 2023 and 2.85 Mteu in 2024.

Related to this influx of new tonnage, the largest in the history of containerized liner shipping, minor capacity reductions due to slow shipping will hardly be noticeable at all.

Add to those faltering freight volumes and a global economy that could well be on the brink of recession. The CII might not be a problem in 2023. However, it will be felt later.

On top of this, Alphaliner expects ship recycling, which has nearly stagnated for the past two years, to see a sharp increase in 2023. As more efficient tonnage comes on stream across all size classes, many more ships Older ones run the risk of receiving reports from the CII prematurely and having them end their careers due to the next mating of their class.

Review and adjustment of the Carbon intensity indicator

In 2025, IMO will conduct a review to adjust or correct CII. The review will be done to ensure the index serves as a viable tool to reduce maritime carbon emissions by 70% by 2025.

One issue that many shipowners highlight in this regard is the carbon emissions from auxiliary engines. Including them in the CII rating leads to the aforementioned problem that being immobile, at anchor or in port, would not be CII neutral and unfairly penalizes ships stuck waiting in slow terminals or in anchorages outside congested ports.

Source: Alphaliner, IMO.